Mileage Reimbursement Government Employee . — only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a. as part of their job, employees may be required to: reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. — an award transport payment is a payment made to you under an industrial instrument that was in force on 29 october.

from meganbond.pages.dev

as part of their job, employees may be required to: — an award transport payment is a payment made to you under an industrial instrument that was in force on 29 october. — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. — only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a.

Employee Mileage Reimbursement 2025 Uk Megan Bond

Mileage Reimbursement Government Employee — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. as part of their job, employees may be required to: — only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a. — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. — an award transport payment is a payment made to you under an industrial instrument that was in force on 29 october.

From eforms.com

Free Mileage Reimbursement Form 2022 IRS Rates Word PDF eForms Mileage Reimbursement Government Employee reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. as part of their job, employees may be required to: — only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a. —. Mileage Reimbursement Government Employee.

From moussyusa.com

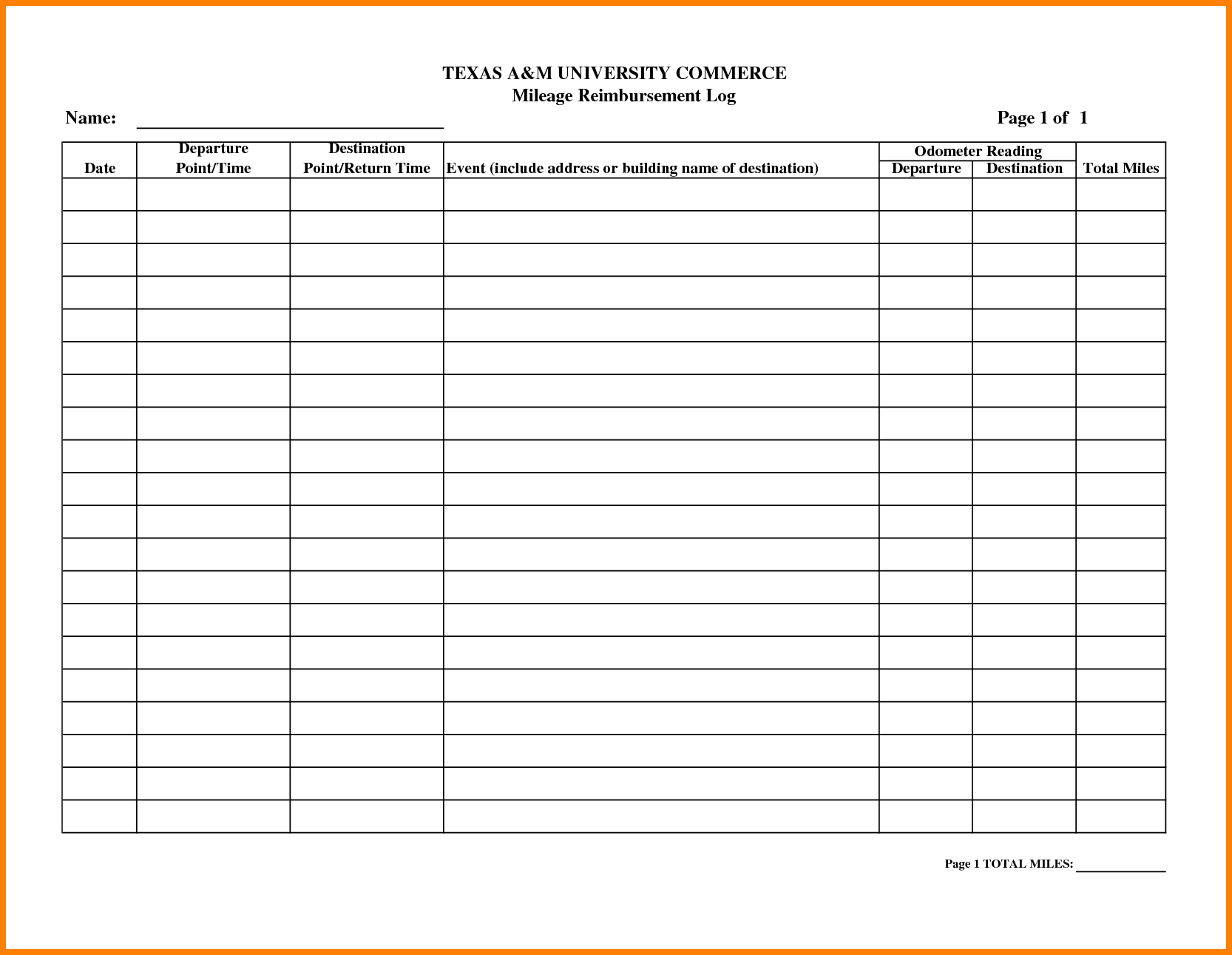

Mileage Reimbursement Forms Sample Mous Syusa Mileage Reimbursement Government Employee as part of their job, employees may be required to: — only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a. reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. —. Mileage Reimbursement Government Employee.

From www.fedsmith.com

GSA Lowers Mileage Rates For 2020 Mileage Reimbursement Government Employee — only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a. — an award transport payment is a payment made to you under an industrial instrument that was in force on 29 october. as part of their job, employees may be required to: . Mileage Reimbursement Government Employee.

From www.sampletemplates.com

FREE 11+ Sample Mileage Reimbursement Forms in MS Word PDF Excel Mileage Reimbursement Government Employee — only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a. as part of their job, employees may be required to: — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. reimbursement of $0.30. Mileage Reimbursement Government Employee.

From www.sampletemplates.com

13 Sample Mileage Log Templates to Download Sample Templates Mileage Reimbursement Government Employee reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. as part of their job, employees may be required to: — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. — an award transport payment is. Mileage Reimbursement Government Employee.

From www.sampletemplates.com

FREE 11+ Sample Mileage Reimbursement Forms in MS Word PDF Excel Mileage Reimbursement Government Employee — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. — an award transport payment is a payment made to you under an industrial instrument that was in force on 29 october. — only use this method if you are a sole trader or partnership (where at least. Mileage Reimbursement Government Employee.

From legaltemplates.net

Free IRS Mileage Reimbursement Form PDF & Word Legal Templates Mileage Reimbursement Government Employee — an award transport payment is a payment made to you under an industrial instrument that was in force on 29 october. — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. as part of their job, employees may be required to: reimbursement of $0.30 cents per. Mileage Reimbursement Government Employee.

From myexceltemplates123.blogspot.com

Mileage Reimbursement Form Word MS Excel Templates Mileage Reimbursement Government Employee — only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a. reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. — an award transport payment is a payment made to you under. Mileage Reimbursement Government Employee.

From mileagereimbursement.blogspot.com

How Much Is Mileage Reimbursement 2021 Mileage Reimbursement 2021 Mileage Reimbursement Government Employee — an award transport payment is a payment made to you under an industrial instrument that was in force on 29 october. reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. — only use this method if you are a sole trader or partnership (where. Mileage Reimbursement Government Employee.

From irs-mileage-rate.com

2021 Government Mileage Reimbursement Rate IRS Mileage Rate 2021 Mileage Reimbursement Government Employee — only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a. reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. — an award transport payment is a payment made to you under. Mileage Reimbursement Government Employee.

From www.sampletemplates.com

FREE 8+ Sample Mileage Reimbursement Forms in PDF MS Word Mileage Reimbursement Government Employee reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. — only use this method if you are a sole trader or partnership (where at least one. Mileage Reimbursement Government Employee.

From ceilyhyacinthe.pages.dev

Government Mileage Rate 2024 Calculator Lorie Jennee Mileage Reimbursement Government Employee — an award transport payment is a payment made to you under an industrial instrument that was in force on 29 october. — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. as part of their job, employees may be required to: reimbursement of $0.30 cents per. Mileage Reimbursement Government Employee.

From www.dexform.com

Mileage Reimbursement Claim Form in Word and Pdf formats Mileage Reimbursement Government Employee reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. — an award transport payment is a payment made to you under an industrial instrument that was in force on 29 october. as part of their job, employees may be required to: — when reimbursing. Mileage Reimbursement Government Employee.

From www.dexform.com

Mileage Reimbursement Form download free documents for PDF, Word and Mileage Reimbursement Government Employee — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. as part of their job, employees may be required to: reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. — only use this method if. Mileage Reimbursement Government Employee.

From www.sampleforms.com

FREE 12+ Mileage Reimbursement Forms in PDF Ms Word Excel Mileage Reimbursement Government Employee as part of their job, employees may be required to: — an award transport payment is a payment made to you under an industrial instrument that was in force on 29 october. — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. — only use this method. Mileage Reimbursement Government Employee.

From www.editableforms.com

Employee Mileage Reimbursement Form Editable PDF Forms Mileage Reimbursement Government Employee as part of their job, employees may be required to: — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. — only use this method if. Mileage Reimbursement Government Employee.

From prntbl.concejomunicipaldechinu.gov.co

Employee Mileage Reimbursement Policy Template prntbl Mileage Reimbursement Government Employee as part of their job, employees may be required to: — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. reimbursement of $0.30 cents per kilometre (km) for the distance of the most direct route between a worker's residence and the. — an award transport payment is. Mileage Reimbursement Government Employee.

From expressmileage.com

Employees Mileage Reimbursement ExpressMileage Mileage Reimbursement Government Employee — when reimbursing an employee for work related travel while using their private vehicle, can i split the award. as part of their job, employees may be required to: — only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a. — an award. Mileage Reimbursement Government Employee.